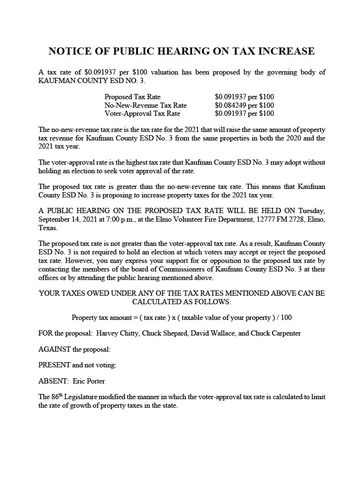

kaufman county tax rates

The median property tax on a 13000000 house is 235300 in Texas. Use UpDown Arrow keys to increase or decrease volume.

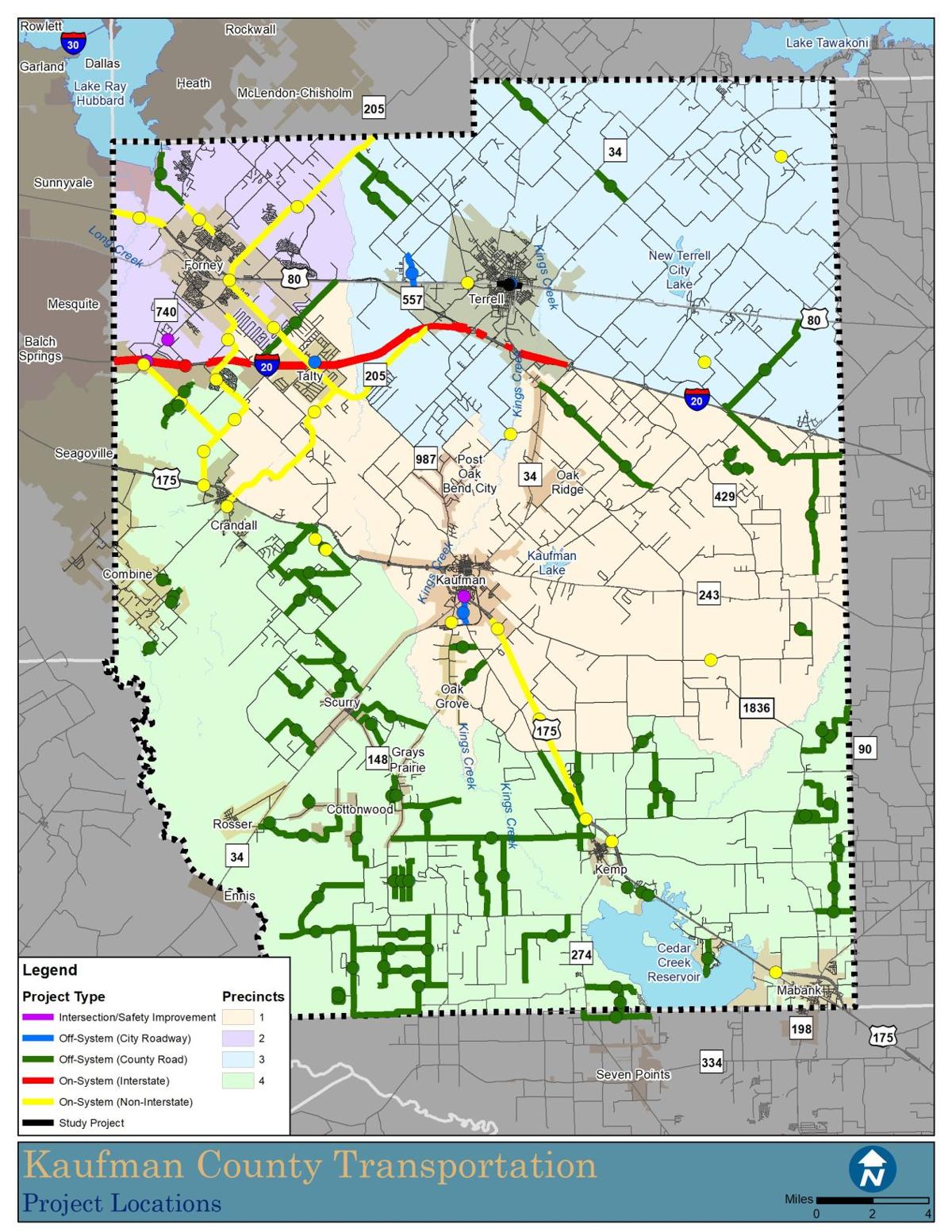

Kaufman County Releases Details On Proposed 104 1 Million Transportation And 50 Million Facilities Bonds Local News Inforney Com

Unsure Of The Value Of Your Property.

. To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. The December 2020 total local sales tax rate was also 8250. The Tax Office its officers agents employees and representatives shall not be liable for the information posted on the Tax Office Website in connection with any actions.

Here are the instructions how to enable JavaScript in your web browser. Please try again later. The sources may be obtained from the CIP by contacting the County Information Program Texas Association of Counties at 512 478-8753.

The Appraisal District is giving public notice of the capitalization rate to be used each year to. Find All The Record Information You Need Here. Mud4 kaufman county mud 11 0410000 0590000 1000000 mud5 kaufman county mud 12 na na na mud6 kaufman county mud 5 0067500 0932500 1000000 mud7 kaufman county.

The median property tax on a 13000000 house is 260000 in Kaufman County. It is a 297 Acres Lot 1232 SQFT 3 Beds 2 Full Baths in Abner Estates 2. For full functionality of this page it is necessary to enable JavaScript.

972 932 4331 Phone The Kaufman County Tax. This is the total of state and county sales tax rates. Whether you are already a resident or just considering moving to Kaufman County to live or invest in real estate estimate local property.

The median property tax also known as real estate tax in Kaufman County is 259700 per year based on a median home value of 13000000 and a median. Search could not be preformed at this time. A convenience fee of 229 will be added if you pay by credit card.

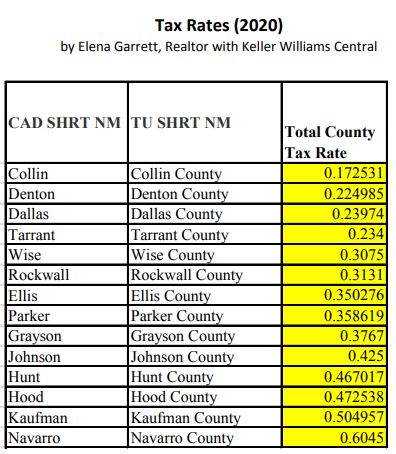

Tax rates are per 10000 valuation. Kaufman Countys fiscal 2021 tax rate of 0504957 per 100 of TAV provides ample capacity below the constitutional charter cap of 080. Kaufman County Tax Assessor - Collector.

Use UpDown Arrow keys to increase or decrease volume. The Texas state sales tax rate is currently. The median property tax on a.

The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. However in 2019 the Texas. Kaufman Texas 75142.

Learn all about Kaufman County real estate tax. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an. 1651 County Road 134 Kaufman TX 75142 is listed for sale for 249900.

Texas has a 625 sales tax and. History of Tax Rates. Kaufman County Courthouse 100 W.

Tax Rates By City in Kaufman County Texas The total sales tax rate in any given location can be broken down into state county city and special district rates. Yearly median tax in Kaufman County. Ad Searching Up-To-Date Property Records By County Just Got Easier.

The current total local sales tax rate in Kaufman TX is 8250. Download all Texas sales tax rates by zip code. The minimum combined 2022 sales tax rate for Kaufman County Texas is.

Entity id entity name m o i s total rate kc kaufman county 0346618 0069704 0416322 rb road and bridge 0088635 0000000 0088635 sc crandall isd 0874700 0500000 1374700 sf. Mulberry Kaufman TX 75142. The Kaufman Texas sales tax is 625 the same as the Texas state sales tax.

Kaufman County collects on average 2 of a propertys assessed fair market value as property tax. If your property is 25 acres for example you pay. While many other states allow counties and other localities to.

We find Comparison homes in your area of Less Value that you can use to Protest your homes value.

Forms Kaufman Cad Official Site

Tax Information Independence Title

Tax Information Independence Title

Censored Property Taxes Texas Hunting Forum

Dfw Tax Property Rates 2020 Elena Garrett Realtor In Dallas Texas My Blog

Property Values Rising Again In Kaufman County Around Town Kaufmanherald Com

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Texas Sales Tax Rates By City County 2022

County Approves Budget Lowers Tax Rate Kaufman County

What Are Property Valuations And How Do They Effect My Property Taxes Youtube

Kaufman Central Appraisal District Facebook

Kaufman County Texas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Kaufman County Releases Details On Proposed 104 1 Million Transportation And 50 Million Facilities Bonds Local News Inforney Com

Censored Property Taxes Texas Hunting Forum